Do you think you may be taking a Home Loan soon and find the entire process confusing and troubling? Identifying the documents required for a Home Loan and comprehending Home Loan eligibility criteria can bring ease into the process. Whether you’re a first-time home buyer or looking to upgrade to a larger space, knowing what financial institutions typically look for can save you time and frustration. In this post, we’ll break down the basics of Home Loan eligibility and outline the necessary documentation you’ll need to streamline your application process. By familiarising yourself with these key aspects, you’ll be better equipped to navigate the world of home financing and move closer to achieving your home ownership goals.

Home Loan Eligibility Criteria

Home Loan eligibility refers to a bank loan system for homes, that financial institutions appraise to ascertain whether you are a good candidate for the mortgage as well as the appropriate amount depending on your prospects. Here are some key factors that determine your eligibility.

- Income: The income level is one of the most relevant factors that are considered when examining your eligibility as a Home Loan applicant. The main method used by institutions to evaluate your ability to keep with the repayment monthly instalments is by sticking to your gross monthly income. The frequent earning either from the salary, business or other sources is taken into account.

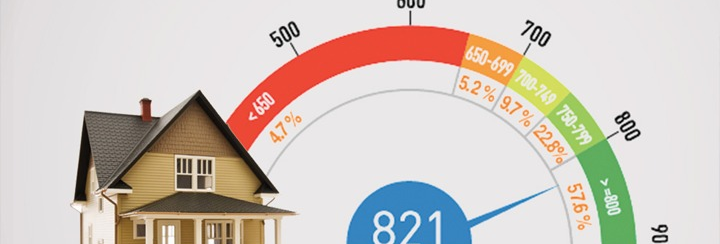

- Credit Score: A credit score with a good rating is the necessary condition for mortgage approval. Your credit score is the metric that financial institutions use to gauge the creditworthiness of clients. A score of more than 700 is the most desired. Timely settling of bills and existing loans assists in keeping an account clean and healthy.

- Age and Employment: Banks usually give loans to those who are not running businesses of high risk because they believe such people are guaranteed the income they need later in the month. Your age and present occupation also indicate your capacity to clear the payment. Generally, salaried employees and self-employed individuals of the age bracket 25-60 years (for salaried employees) and 25-65 years (for self-employed individuals) are eligible for inclusion.

- Existing Financial Commitments: The financial institution takes into account your existing commitments concerning credit lines like liabilities and loans and also such subsidies for which you could be eligible. Meeting the required conditions with minimum obligations is a winning strategy.

- Property Valuation: The property you are planning to buy is also a key element in your financial situation. Financial institutions will arrange an evaluation to make sure that the value of the property/collateral that has been submitted is with the amount being sought as a loan.

Documents Required for Home Loan

Now that you understand the factors affecting your eligibility let’s take a look at the essential documents you need to submit when applying for a Home Loan.

- Identity Proof: Status documents, for example, an Aadhaar Card, passport, voter ID, or driving license function as identity proof.

- Address Proof: Utility bills, Passport, Aadhaar Card, etc. are a few examples of address proof.

- Income Proof: The salaried ones have to provide the monthly salary slips, Form 16 of Income Tax, and bank statements of the particular year for the same. Individuals who have opted to run their own business should fill out Income Tax Returns (ITRs) by providing profit and loss and balance sheets along with the returns.

- Employment Proof: Salaried workers are required to show job evidence, for instance, an appointment letter or a certificate from work by law. Self-employed persons are expected to provide evidence of their business existence; that can be achieved through the GST registration certificate or business licence.

- Property Documents: About the property, the documents that are essentially needed comprise the sale deed, the title deed, and the construction agreement.

- Bank Statements: It is required of you to provide bank statements from the last 6 to 12 months confirming your financial transactions, including deposits and withdrawals, plus your savings habits.

- Income Tax Returns: Jointly, the last 2 to 3 years’ ITR (both the salaried and self-employed) need to be submitted for the salaried and those who are self-employed.

- Photographs: As per the updated know-your-customer policies, passport-sized pictures are needed for the KYC process.

Conclusion

Securing a Home Loan can prove to be a very integral and major aspect of the path to acquiring

a house. Comprehending the eligibility requirements, proof of income as well as other documents required for Home Loan will improve your chances of approval and you’ll be able to submit your loan application much easier.

Through the main documents submission, you get these basic documents, like identity proof, address proof, income proof, employment documents and property documents and bank statements, and your income & income tax returns, the entire procedure becomes easier and faster.

Having this guide as your Home Loan eligibility and what essential documents are needed to crucially make clear-headed decisions and face the journey of home ownership prospects with assurance!